ie IPTV, VoIP have taken the world by storm. Broadband internet, interactivity and TV can all be delivered on the existing phone lines or via wireless eg WiMax. The last leg eg 100 m to the home has been a new service provider掇 nightmare, until IPTV emerges. It is challenging conventional delivery platforms such as satellite, cable or even terrestrial ones. Technology development, being what it is, follows discontinued S-curves and moves with innovations and the perennial gale of creative destruction (J. Schumpeter, 1942). This paper continues from a previous one on HDTV Development (J. Yip, Media Digest, March 2006), to explore the perplexing relation between economics and the latest Triple TV technologies (HDTV/ IPTV/ Mobile TV, or HIM), plus having a look at Hong Kong. A concept of economic cultivation for IPTV is introduced.

IPTV Delivery

IPTV embraces HD (High Definition) and SD (Standard Definition). SD can be delivered using ADSL (Asymmetrical Digital Subscriber Lines) or ADSL2 but HD requires ADSL2+ or preferably VDSL2. Compression is commonly by way of MPEG4 Pt.10/ AVC / H.264 or VC-1/ WMV. Data rates for SD range from 1 to 2 Mbps, and for HD 8 to over 12 Mbps, falling to 6 Mbps soon. Phone lines may remain unchanged but network infrastructure upstream needs major upgrading for HD, using optical-fibre systems. FTTP (Fibre to the Premises) with BPON/ GPON (Broadband/ Gigabit Passive Optical Networks) may be deployed for increased throughput.

Economics Again

In the previous paper, growth has been linked to GDP and GDP-per-capita, with Affordability Index (AI) introduced as the normalized (GDP * GDP-per-capita), for an economy, GDP being based on PPP (Purchasing Power Parity). The previous analysis suggested that a fourth HDTV/ DTT standard would be established by mainland China. This materialized in August 2006 with the announcement of the Chinese national DMB-T/ H standard. Furthermore, the industry in Hong Kong is moving in this direction, potentially realizing the synergy. Presently, it seems unlikely that yet another DTT/HDTV standard will emerge.

(a) IPTV- HD

IPTV-HD is one form of HDTV delivery but spectrum scarcity is not relevant. Other licensing and regulatory factors still apply. For terrestrial or IP delivery, Propelling Factor, HDF = M (r, p, m, o) * (GDP * GDP-per-capita), as explained in the previous paper. IPTV-HD has emerged eg Verizon in USA introduced FiOS using FTTP eg in New York with HD channels and SaskTel in Canada offered IPTV-HD.

(b) IPTV- SD

This is influenced by consumer behaviour, market competition, etc. It is also subjected to GDP-per-capita in a targeted market as a pay service is assumed, for revenue. Consumer-spending power is crucial for a healthy ROI. There exists over 5M IPTV subscribers, with concentrations in Hong Kong and France but the global subscriber base could exceed 40M in the next few years. In analyzing IPTV, GDP-per-capita (PPP) is a key factor. Deploying complex IP networks (including QoS, scalability, reliability/ resiliency and security considerations) depends, inter alia, on geography and population density (persons/ sq. km). The driving force is postulated as follows:

IPDF = Mi (r, p, m, o)* GDP-per-capita * Population Density, GDP being in PPP

= Mi (r, p, m, o)* GDP/population * population/ area

Hence, IPDF = Mi (r, p, m, o) * GDP/ area

GDP/ area (ie US $billion/ sq. km) is interestingly akin to crop yield in economic cultivation or harvesting. IPDF applies only to a city-sized economy but not to countries with large barren areas. The equation is useful for predicting IPTV growth (ie applicable to the growth phase, just like the other equations in this paper).

(c) Potential, IPTV-SD

Three economies: Hong Kong (a harbour-city), Singapore (a garden-city state) and France are studied. For France, the Paris region is chosen instead; it yields about 1/4 of the GDP of France. Estimated (GDP/ area) yields are as follows (data from the World Fact Book and Wikipedia), GDP (PPP) being in US $billion and area in sq. km.

Hong Kong: 227.3/1092 = 0.21,

Singapore: 124.3/693 = 0.18,

Paris (metro): 454/2730 = 0.17

Their average is 0.19 and Hong Kong leads. The above provides a benchmark for estimating the growth potential in a city-sized economy. One research report (Informa, 2006) has ranked the top players in IPTV penetration by 2011 to be: Hong Kong, France, Singapore. A yield of 0.1 (US $billion per sq. km per year, PPP) is a useful benchmark; 0.1 (+/- 0.05) gives a medium yield whilst 0.16 or above a high yield. Narrowing a target area enriches the yield as shown below.

Based on GDP (PPP) in 2005, estimated yields for some cities in China are: Guangzhou (0.14, 3,719 sq. km), Shenzhen (0.11, 2,020 sq. km), Shanghai (0.07, 6,341 sq. km). Beijing Municipality (8,868 sq. km) has a yield of 0.04, but for its populous inner suburb areas (1,378 sq. km) the yield is 0.13. Thus, it makes business sense to start in densely populated city areas. In S. America, dual yields occur for two sample areas: Sao Paulo of Brazil (City: 0.11, 1,523 sq. km; Metro: 0.04, 8,051 sq. km) and Mexico City of Mexico (D.F.: 0.09, 1,499 sq. km; Metro: 0.05, 4,979 sq. km). H/L ratios for these sample dual-yield city economies range from 1.8 to 3.5. In Australia, the yield for Sydney is quite low: (0.013, 12,145 sq. km).

(d) Potential, IPTV-HD

If IPDF is applied to USA and Japan, fertile yields (over 0.25) could be found: New York: (City: 0.37, 1,214 sq. km; Metro: 0.05, 17,405 sq. km) and Tokyo: (0.53, 2,187 sq. km). The high AI of USA (100) and Japan (23.4), plus these high yields, point to a good potential for IPTV-HD growth in these cities, this being also dependent on Mi, the subjective factor.

Mobile TV

A new media technology is Mobile TV eg T-DMB and S-DMB (S. Korea), DVB-H (Europe), MediaFLO (USA), ISDB-T/ One Seg (Japan), CMMB/ STiMi (China). The following postulates the growth of Mobile TV. Compared to IPTV, SD or HD, content production costs are low. However, handsets and service costs (setting aside subsidies) are still quite expensive; affordability is an issue.

Propelling Factor (MDF) = Mm (r, p, m, o) * GDP-per-capita* T

where T is the Terrain Factor (0 < T =< 1), and MDF applies to a city-sized economy.

Terrain includes hills and concrete housing estates. In providing a reliable service (eg 90% of time and 90% of locations) and to avoid the recovery time due to motion/ blockage induced interruptions, T is a retarding factor, especially critical for pay services. Depending on frequency eg VHF for T-DMB or UHF for DVB-H, an assessment may be made based on the number of VHF or UHF TV transmitters already deployed. T is frequency band and also technology dependent. By combining satellite and terrestrial (broadcast, or 3G/ 3.5G cellular) networks, T can be enhanced. S. Korea has over 2.2M T-DMB and 0.8M S-DMB sets, indicating a strong Mm influence. Global data is still scanty.

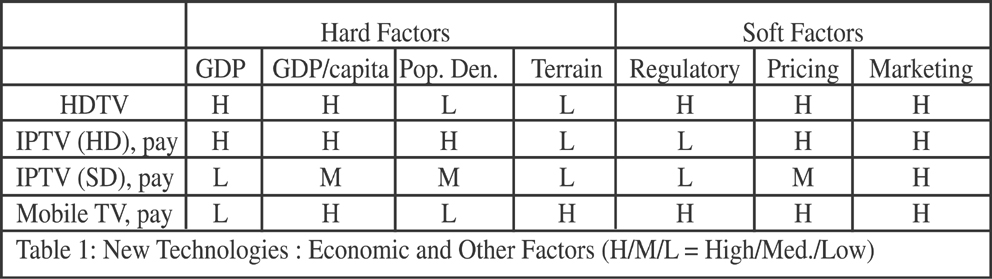

Overview of HDTV, IPTV and Mobile TV

Table 1 shows various macroeconomic/ microeconomic/ technical factors. Other factors (the “o” in the equations) eg content development and consumer behaviour apply. For IPTV, the regulatory factor is low as spectrum scarcity is not an issue. For Mobile TV, the population density factor is low if a broadcast (non-cellular) system is used. Marketing (promotion) is important. The old adage 烓now your customers?applies. Many people still do not understand IPTV. The technologies are subjected to market forces; oligopoly or monopoly may apply to the operators, whereas monopolistic competition (high end) and perfect competition (low end) may apply to consumer hardware.

A Look at Hong Kong

Hong Kong with some 7M people has a high GDP-per-capita. With a household broadband penetration of over 67%, it actively invests in new technologies, as evidenced by the huge growth in IPTV (over 0.7M subscribers), cable and satellite TV services.

Hong Kong could foster DTT/ HDTV development by exploiting the synergy with mainland China that has one of the highest GDPs (PPP) in the world hence could create the requisite technologies and contents. Hong Kong, with a high consumer purchasing power, could help accelerate HDTV rollout, HDTV implying both terrestrial and IP deliveries but not up-converted SD program content.

The mobile phone subscriber penetration rate is over 131% (9.2M subscribers) and there are over 2.1M 2.5G/ 3G subscribers. Deploying a wide-area broadcast ie non-cellular system for Mobile TV brings in additional issues eg spectrum availability and signal interruptions due to blockages/ movements. The terrain factor is important in Hong Kong, for pay services. A free to air (FTA) service is an alternative.

Summary

IPTV development is accelerating globally. It is an integrated, flexible and yet simple delivery platform, particularly suitable for cities with a high broadband internet penetration and a dense population. Its growth is influenced by economic and other factors. This paper has addressed IPTV (HD and SD) and introduces the concept of yield (GDP-per-sq. km) for benchmarking a city-sized economy. Dual yields may occur in a large city. IPTV has also been compared with other media technologies such as terrestrial HDTV and Mobile TV, to contribute to the understanding of the Triple TV technologies.