Various Types and Features of VoD

Video-on-demand refers to any video service that improves user’s controllability on video environment and experience and allows viewers to select and watch on their demand. It is an advanced pay-per-view programming service, enabling viewers to order and watch movies on demand. As a system, VoD enables users to receive audio-visual material through either streaming or downloading at the time and place of their needs. For the improved user-controllability, VoD technology provides the transfer of digitally compressed and encoded visual information from a central storage facility, called a video server, to a decoder, called a set top terminal (STT) of individual subscribers. At the decoder, the compressed video contents are reassembled, decoded, and presented at the monitor and viewers would be instantly enjoyed them on their time schedule.

VoDs have been categorized into at least four types by its revenue-model and service features; subscription video-on-demand (SVoD), free video-on-demand (FVoD), true video-on-demand(TVoD), and near video-on-demand(NVoD). The classification between SVoD and FVoD is made based upon their revenue models. SVoD services generally offer premium contents like movies, sports, and music for a payable transaction or as a part of subscribed-television package. On the contrary, FVoD services are provided with no charge and are generally financed by advertising.

The classification between TVoD and NVoD is made more upon its technological aspects and service features. TVoD is the most customized, user-oriented service through realizing simultaneous interactivity, whereas NVoD still restricts user’s flexibility in video experience and environment. TVoD provides simultaneous service features and all the typical VCR-like controls, which allows users to control replay speed, media quality, subtitles, and even camera angles. To offer simultaneous TVoD, service providers should have a dedicated video stream for each customer. Therefore, this service type requires greater network bandwidths and is more expensive to operate, especially when multiple customers want to access multiple identical video streams. As a more commercially viable option, NVoD emulates an interactive video service by batching multiple clients to a series of repeating time-shifted services mainly at a scheduled time. NVoD technology allows multiple users to access multiple identical contents of the preceding channel in the sequence to share the same video stream. Although NVoD still restricts viewer’s controllability within the predetermined programming, this type of VoD allows viewers to pause the video for an amount of time depending on the number of shifting channels.

Fast Growing Penetration

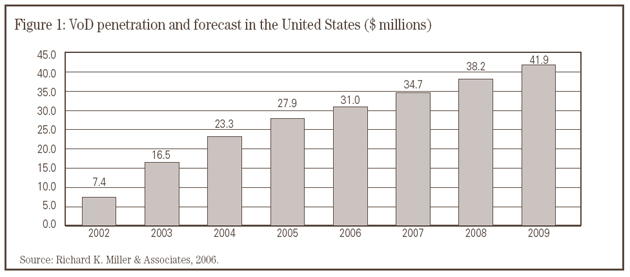

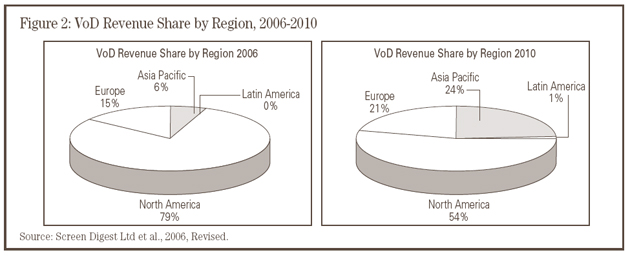

Despite the fact that VoD is a relatively new technology, during the last few years its penetration has been increasing rapidly. Currently, North America has taken the largest market. By the end of 2006, it had 79% of the global revenues. It was estimated that the number of VoD-enabled homes in the United States reached 31 million at the end of 2007, and it was forecasted that the number would increase to 42 million by the end of 2009. In addition, 72% of digital-cable subscribers who have paid for VoD rank it as the most valuable aspect of their digital TV service. According to the Nielsen Media Research’s estimation, presently the penetration rate of VoD households in the United States is around 40%.

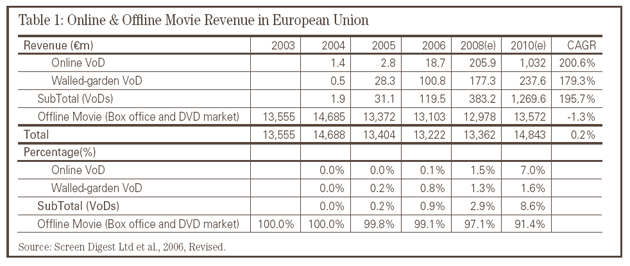

Compared to North America, European VoD market is smaller, but it is fast growing and lucrative. While taking only 15% of revenue share in the world VoD market, Europe has a slightly higher ARPU than North America. Although digital video on-demand is currently very nascent, it already started generating revenues. By the end of 2005, it had €30m revenues. Most of revenues came from set-top box based “walled garden” services (€28 million), the rest being generated by online services (€2 million). This early stage of VoD market represented a barely measurable percentage of total European movie market—over €13bn in 2003 from box office and DVD/VHS revenues. However, as shown in Table 1, both online VoDs and walled-garden VoDs are estimated to grow up to nearly €1.3bn by the end of 2010. The compound annual growth rate of VoDs is expected to be around 180~200% by the end of 2010. The bulk of digital revenue (€1billion) will come from online VoDs (open gateway download services), approximately accounting for 7% of all movie revenue in Europe.

European subscribers are now able to access VoD services from approximately 258 paying VoD services active across 24 European countries. Presently, the market leader in Europe is France, which has a competitive pay television industry. French subscribers can access 14 television-based and 26 internet-based VoD services. The Netherlands, Germany, Sweden, and the United Kingdom also stand out as leaders with a large broadband and cable pay-TV infrastructures. The number of VoD services in these top five countries approximately accounts for 47% of total numbers across Europe. However, TVoD services over digital cables are very limited and are just in a small number of countries. It is because many European countries still mainly have analog cable infrastructures, including the United Kingdom, Germany, Belgium, and Spain. However, many of them have been making efforts to upgrade their systems. For example, in the United Kingdom the NTL-Telewest FilmFlex Service was extended its reach to 2.2 million subscribers by the end of 2006 from 250,000 in mid-2005.

Prospect of VoD

Starting from a base of $2.7 billion in 2007, the world’s VoD revenues are estimated to reach $12.7 billion by the end of 2011, accounting for 67.6% of the compound annual growth rate. In the next few years, VoD will be one of the fastest growing digital content services. It is expected that more telcos, ISPs and cable operators across the globe will launch their on-demand content propositions and to move themselves into content distribution. It is also estimated that 435 million homes around the world would access TVoD or NVoD services by the end of 2011, equivalent to 38% of global television households.

In the near future, North America will continue to be the largest market, having 46% of global revenues and 27% of subscriber-share from 117 million subscribers. It is forecasted that Europe’s revenue share will increase up to 21% as of the end 2010, though it will still be smaller than North America’s revenue share (54%). The VoD revenues in U.S. will triple to $ 6.8 billion in 2011, while that of Europe will reach to $ 2.7 billion. Although the compound growth rate of European market will rapidly grow, the market size will be roughly half of the U.S. The compound annual growth rate of revenues in both regions will account for 40% (U.S.A.) and 60% (Europe).

In terms of service features, NVoD is being retained for the near future while operators gradually ratchet-up TVoD contents. Ultimately, subscription-VoD (SVoD) will account for more than 60% of total revenue globally by 2012 because it resonates best with consumer’s demands. Revenues from VoD transactions and subscriptions will grow along with the unit sales, from a global total of $121million in 2006 to $4.7 billion in 2012, 18% of the global IPTV revenues.