Digital radio has been making inroads after over 15 years of development. The early system, DAB (Digital Audio Broadcasting), of the Eureka 147 family was introduced in the mid 1990’s. In recent years, newer technologies have emerged. The major digital radio technologies include the Eureka 147 DAB family, DRM family and HD-Radio (used mainly in USA). DAB (using MP2/ MUSICAM) has been around for over 15 years with major growth in UK with 10M receivers. DAB+ (using HEAAC v.2, 3 times more efficient than MP2) has been introduced in Australia in May 2009, showing promising growth. DAB+ is also growing in various other countries eg Switzerland, Italy. DRM (DRM30, DRM+) is more spectrum-efficient but receivers are more expensive; it is promising for providing distant services and replacing AM. This paper discusses the growth (receiver penetration) factors, an externality (technological competitiveness), developments in UK, Australia and HK, focusing on DAB+, to facilitate planning in an expanding and competitive multimedia environment.

2. Growth Factors

2.1 Key factors affecting growth (ref. Media Digest 2007-06, J.Yip): Driving Force (Digital Radio): DFdr = Mdr [R,P,M,O]*T. For the Terrain factor (T), a basic description was given in Media Digest 2008-03 (J.Yip).

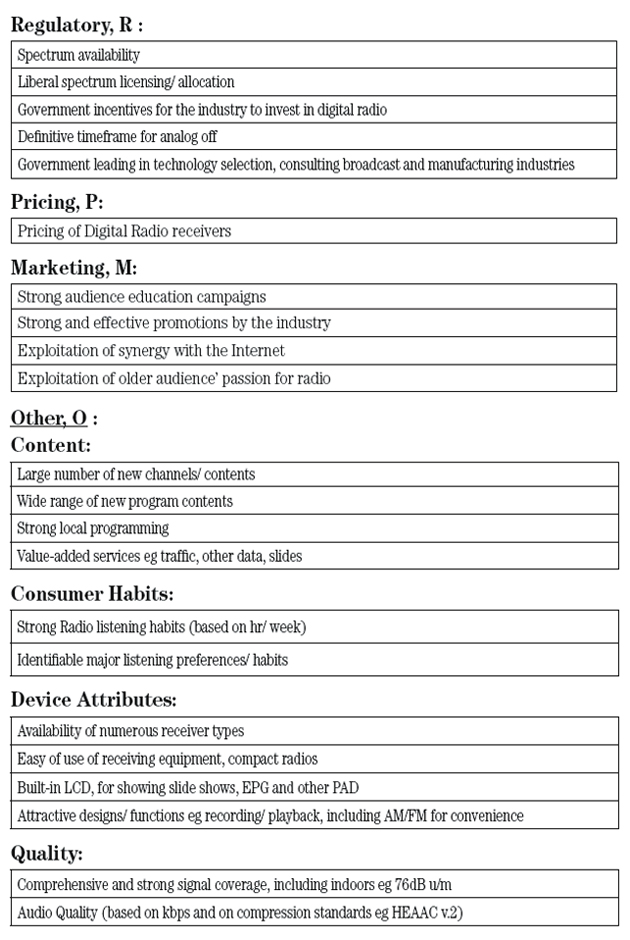

2.2 RPMO factors and components are given as follows.

There are numerous articles written on digital radio, pointing out that the main drivers for DR growth are: new digital radio stations and contents, consumers being attracted to new devices, designs/ features, and improved sound quality (under good reception), etc. These correspond to the “O” factors in the RPMO analytical model. The receiver pricing issue is often discussed. On economic affordability of the consumer, it is not an issue in a developed economy. It is related instead to opportunity cost, not to affordability. This matter will be discussed later. A related equation, on receiver pricing, is as follows: Price A = Price B * (ratio of GDP/capita) * (ratio of consumption in hours/week)

Further to the RPMO equation, there is an important externality, arising from the limited technological competitiveness of digital radio in the multimedia (audio-visual) environment. This externality (Tc) is described as follows.

2.3 Technological Competitiveness (Tc):

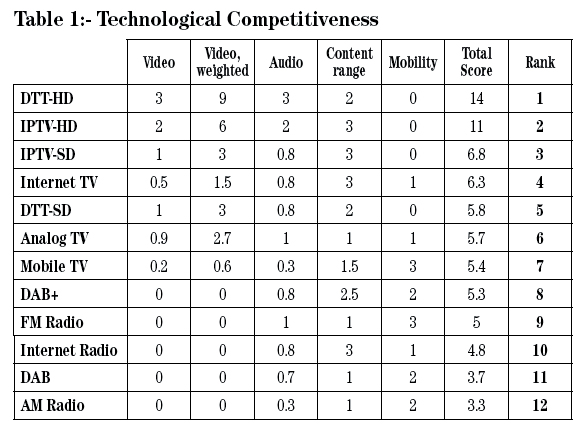

If “Seeing is Believing”, then Radio was born handicapped, as it could not provide moving video information or entertainment. The following table on Tc is postulated, to show the limited competitiveness of digital radio. A rollout of digital radio needs substantial efforts/ investments, as it has to compete for the hotly-pursued consumer attention. (Table 1)

3. Digital Radio Developments in Selected Economies

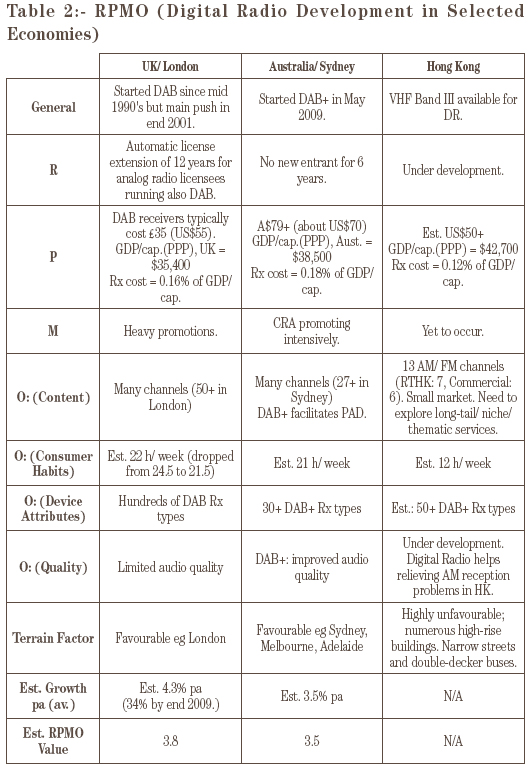

We shall explore the growth factors by referring to the developments in UK (well developed in DAB), Australia (having a good start in DAB+) and Hong Kong (with digital radio emerging). The following is a summary table of the various factors: RPMO, Terrain, Growth, and estimated RPMO values using the aggregate curve (Media Digest, 2009-04, J. Yip, Figure 1) developed for HDTV and IPTV. The curve has been used as a surrogate, due to limited digital radio penetration, apart from that in UK.

4. Fostering Digital Radio growth

The following energizing measures are based on the RPMO analytical model and on Table 2.

- Proactive regulatory framework, providing incentives for the industry to invest in digital radio.

- Lowering digital radio receiver prices.

- Prolonged and effective promotional campaigns.

- New/ extended range of contents, with local programming.

- Exploiting consumers’ habits eg listening to radio whilst on the internet, reading, walking or working.

- Exploiting older people’s passion for radio.

- Wide range of receiver types with attractive designs/ features, including AM/FM.

- High audio quality by using suitable bitrates.

- Strong signal reception even for indoors; using repeaters eg echo-canceling repeaters.

There is no single measure for ensuring a successful rollout and each economy needs to set its own strategies.

5. Summary:

Rolling out digital radio successfully is a challenging task, partly due to the limited competitiveness of digital radio in the intensifying multimedia environment (Table 1). The generic growth equation and the benchmarking curve (albeit ballpark) could be useful for planning digital radio rollout. In Hong Kong, HDTV and IPTV have attained high penetration figures, reaching some 40% and 50% respectively (averaging 20% pa and 10% pa respectively). For digital radio development in Hong Kong, Table 2 has outlined some obstacles. Major efforts are required to parallel the growth in UK or Australia.