Radio has been a stable media over time, as it satisfies a basic human need, i.e. to be connected and engaged to the other end, through listening. It is a minimal-effort media. By allowing us to multi-task, Radio secures its place in the modern and busy world. This paper looks at Radio in Asia, based on the RPMO analytical model (J.Yip, Media Digest, 2006-2010). For any consumer technology, the first 2 pertinent questions are: (1) How much? i.e. Can I afford it? and (2) Is it worth it? , i.e. Should I buy it, on considering the opportunity cost?

A Snapshot of Asia

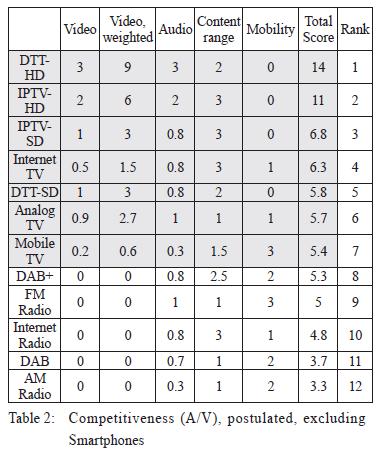

Table 1 shows the radio sets per 1000 persons, in some Asian economies, and their GDP-per-capita (PPP, Purchasing Power Parity) in US$k.

References :

(a) http://earthtrends.wri.org/text/population-health/variable-699.html

(b) https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html

High receiver ownership occurs in economies with high GDP-per-capita. Worldwide, for 1,000 persons, there are about 1,267 radios for a high-income group, but only 138 for a low-income group. Radio receiver cost is hence a critical issue.

For a 90% home penetration (say, 3 persons per home), GDP-per-capita (PPP) has to be over $7.5k pa. A radio (AM/FM) costing say $15 is only 0.2% of the GDP-per-capita, this being the average “marginal value (or in economic terms, marginal utility)” of a radio set to the consumer. For a digital radio receiver of $50, only high-ranking economies are likely to pay for it.

Radio in the Competitive Multimedia Environment

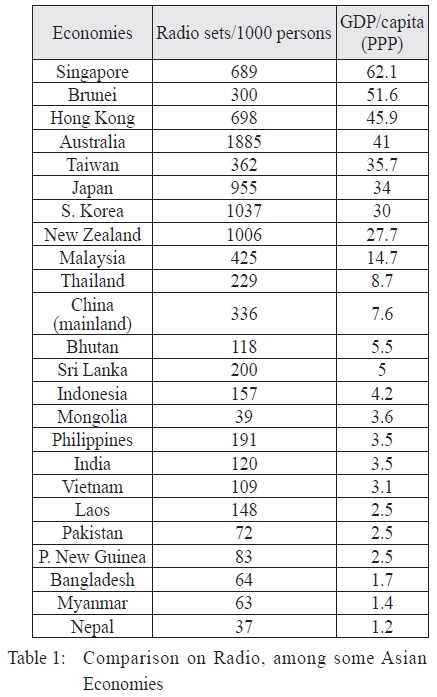

Now, we come to the second consumer question on affordability. Table 2 has been postulated, to show its limited competitiveness (before the emergence of powerful smart-phones with wireless broadband internet access). The smart-phone boosts mobility to a value of 3, yielding a total score of 6.8 (for the radio part), helping the Radio group (ranging from DAB+ to AM Radio) break its rank. Radio listening on smart-phones is hence an important issue.

RPMO Model and Analysis

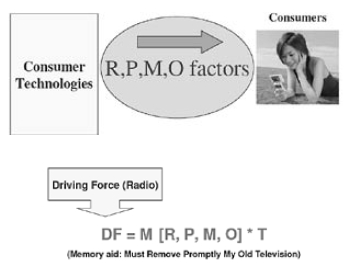

The equation and a conceptual diagram are given below, for analyzing the driving-force factors.

Key Factors Affecting Growth

For the Terrain factor (T), a basic description was given (J.Yip, Media Digest, 2008/03 , on Mobile TV Development).

RADIO, RPMO factors and their components

Regulatory, R:

- Spectrum availability

- Government incentives for the industry to invest

- Definitive timeframe for analog radio off

Pricing, P:

- Pricing of Radio-capable devices

Marketing, M:

- Strong and effective promotions by the industry

- Exploitation of older audience’ passion for radio

Other factors, O:

O1: Content:

- Large number of new channels/ contents

- Strong local programming

- Value-added services eg traffic, other data, slides

O2: Consumer Habits:

- Strong Radio listening habits (hours/ week)

- Identifiable major listening preferences/ habits

O3: Device Attributes:

- Availability of a wide variety of device designs

- Easy of use, light-weight, long battery life

- Built-in display, for EPG

- Attractive designs/ functions; FM built-in

O4: Quality:

- Good signal coverage

- Audio Quality (based on bitrate and encoding)

We now compare the 3 major groups of radio-capable devices, using the RPMO model:

* AM/ FM receivers (FM), including feature mobile phones with built-in FM

* Digital radio receivers (DR), eg DAB+

* Smart-phones (SP), with OS and 3G/ 4G/ WiFi

R (Regulatory):

Regulation of SP internet radio access is generally less stringent than that for FM or for DR.

P (Pricing):

FM is extremely price-competitive. DR is less so. SP (with mobile subscription) is most expensive among the 3 technologies. A related general equation on receiver pricing, is as follows: Price A = Price B * (ratio of GDP/capita) * (ratio of radio listening in hours/wk)

M (Marketing):

FM is fully mature, but DR requires intensive marketing. SP has been vigorously marketed by manufacturers (eg Android, iOS and Symbian phones)

O1 : (Content):-

FM and DR capitalize on local content. Content on SP (and PC for that matter) is huge. Due to the large number of channels, it could cater for “Long Tail” consumer needs, across countries.

O2: (Consumer Habits):-

Listening hours per week vary greatly among Asian countries, ranging from 13 h/wk in China to 24 h/wk in Malaysia (although Malaysia’s receiver ownership is moderate). Consumer habits are hard to change. Most listen regularly to only several channels and want to carry around just one mobile device. SP has widen access to radio services; internet listening is rapidly increasing.

O3: (Device Attributes):-

On ease of use, FM is the best and SP is the worst, hence older people (who are loyal to Radio) find FM more user-friendly. Features on FM are most limited and those on SP are the richest; DR is somewhere in-between.

O4: (Quality): -

FM, DR and SP can provide high-quality audio, given good reception. FM networks are well established and SP signal networks are being perfected by resourceful telcos. Radio broadcasters have to build DR networks; hard economics comes in.

The RPMO values for FM, DR and SP for each economy can be computed by using the following RPMO calculator, downloadable from RTHK, under HDTV and IPTV Development (Media Digest, 2009/04)1.

The various pparameters vary from one economy to another, so specific RPMO values for FM, DR and SP cannot be easily calculated for Asia as a whole. The most sensitive parameter appears to be P (Pricing). DR and SP growths (penetrations) in an economy are substantially constrained by its GDP-per-capita. For high-income economies, rapid growth of SP sales in Asia (84M in 2010, 137M units in 2011, IDC), easily eclipses those of DR, as SP offers additional high-value multi-media/ communications features.

Fostering Radio Growth

Based on the RPMO model, the following measures are required:

- Liberal regulatory framework, providing incentives for the industry to invest.

- Lowering radio receiver prices.

- Prolonged, effective promotional campaigns.

- New/ extended range of contents, with local programming.

- Better understanding of the modern consumers’ habits.

- Exploiting older people’s passion for radio and the younger people’s preference for internet radio.

- For receivers: ease of use, attractive designs/ features, light-weight, long battery life. For DR and SP, built-in FM receiver reduces spectrum demands for wireless data.

- Strong reception even for indoors. For internet radio service, ensure adequate service bandwidth.

Summary

Inherent factors affect Radio growth e.g. GDP-per-capita, consumer habits, limited interactivity on FM and on digital radio. Growth of radio in Asia may be enhanced by building on the strengths of Radio (minimum physical effort, multi-tasking), ability to take the listeners onto a mental tour (inform, educate, entertain, much the same as being a good tourist guide), focusing on local content, etc.

Digital Radio is a bridging technology, in terms of techno-economics. Intensive efforts in receiver price reduction, marketing/ promoting, content development and, for a city like Hong Kong, transmission improvement (but deep-indoor reception could be solved by using a smartphone on home WiFi). Despite this, digital radio has a huge advantage in being not subject to the increasing internet congestion problem eg in wireless data transmission.

Thus radio broadcasters need to embrace the smartphones, capitalizing on the internet, eg interactivity, EPG, extended program information, apps for easy access of radio channels, interconnecting to social media. Improved wireless spectrum utilization can be achieved by equipping smartphones with FM (and DAB+).

1. http://www.rthk.org.hk/mediadigest/class/index_tech.html