Delivery Systems

Technologies are transient and delivery systems operate in VHF, UHF, L and S bands. VHF provides better penetration but antennas are large. At higher frequencies eg. L-band, higher signal loss through buildings results in higher transmitting power, more local translators and difficulty in maintaining SFN stability. Broadcast systems include ISDB-T, DVB-T/H/T2, ATSC-M/H, CMMB, S/T-DMB, MediaFLO; cellular-based systems may use MBMS, HSDPA, WiMax. In-band systems offer economic benefits as network resources could be shared; the success of ISDB-T/ One-Seg in Japan is notable.

Generic Growth Equation

A generic growth equation was described (J.Yip, Media Digest, 6/2007). Driving Force: DF = Function (soft and hard factors) = M (r, p, m, o) * H (G, g), where r, p, m, o, G, g = regulatory, pricing, marketing, other, macroeconomic and geo-physical factors respectively. “o” include content, consumer habits, device attributes and quality. Technology is reflected in terms of pricing, device attributes and quality.

For Mobile TV in a city the equation is: Driving Force (DFm) = Mm (r, p, m, o) * GDP-per-capita* T, where T, the Terrain Factor (0 < T =< 1,) is a retarding factor.

On the regulatory side, a government or market driven arrangement may dominate. Issues include RF spectrum usage, licensing for broadcast and cellular modes, technical standards, cross-platform content flow, etc. On pricing, a free-to-air model helps create the critical mass, before deploying a pay model. Market competition is likely to be oligopoly. Operators could share a common mobile TV network to lower costs. On marketing, promotion could exploit the young generation’s attraction to handset designs/ styles and to cultivate consumer habits such as social networking. Other issues include content (eg. major live events, news, drama, mobi-soaps, sports, music, VoD, catch-up and condensed TV, premium content, UGC), consumer habits, handset availability and functionality/ features (eg. battery life, weight, screen size, frequency bands) and picture quality/ stability.

Metrics

On using a 5-point scale: 5 (excellent), 4 (good), 3 (fair), 2 (poor) and 1 (bad), an economy/ city could be benchmarked against another. Applying metrics is exemplified below for IPTV (J.Yip, Media Digest, 12/2006) in a hypothetical city: r = 5, ie a highly liberal regulatory environment. p = 4, ie. low entry pricing, bundling with broadband internet plus la-a-carte pricing on premium content. m = 5, ie. intensive promotional efforts. The Other factor = 3.9 ie. the geometric mean of these 4 sub-factors: Content = 5, ie. offering over 100 channels, Consumer habits = 3, ie. viewers having a moderate TV viewing habit (based on average hours per week) among world-wide viewers (eg. GfK NOP, Media Habits, 2005), Device attributes = 4, and Quality = 4. The geometric mean of the 4 soft factors (r, p, m, o) is 4.4 which is high and favourable.

Beyond the Equation

‧Sustainable Growth

Rapid penetration does not necessarily mean fast revenue generation. An aggressive launch could be at the expense of the government or industry. If the business model is not robust, growth withers soon since breakeven is not reached before the technology becomes obsolete. The churn rate for Mobile TV can be high. One thought is to attain the critical mass using penetration pricing plus heavy promotion, followed by affordable schemes eg. smart bundling of attractive and exclusive premium content. Value-added services are also needed.

‧Government/ Broadcaster/ Telecom Operator

A government often plays an important part. The following successful roll-outs suggest that strong government support has been an influencing factor: DAB and DTT in UK, T-DMB in S. Korea, ATSC in USA and ISDB-T in Japan. A government may get involved following economic cost-benefit analyses. The previous HDTV paper (J.Yip, Media Digest, 3/2006) shows that China has a high affordability index (AI) at country level, despite a modest GDP/capita. CCTV introduced in Jan. 2008 a free national HDTV channel, prior to Olympics 2008, this facilitating consumers' entry to HDTV.

A "triangle" may be found among the government, the broadcaster and the telco. This tri-partie relation could further be translated into: regulatory framework, content services and network/ terminal services. The telco is a key player in IPTV and Mobile TV where cooperation between the two parties is beneficial, eg. using the telco network as a return path for interactivity and revenue. The new digital era with quad play places new demands on cooperation. In a market-driven environment, a government could still foster development by minimizing regulatory barriers and licence fees; one may recall the Coase Theorem. The government may consider giving it a push, subjected to social cost-benefits.

Terrain Factor

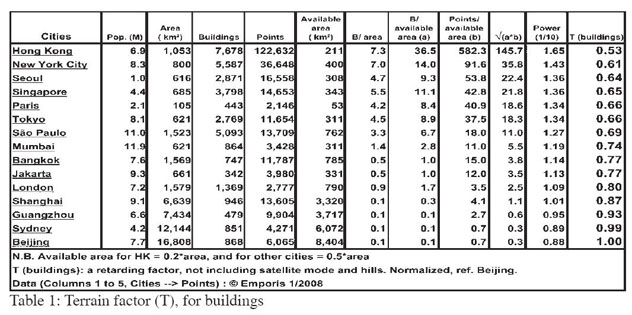

This factor (T) for a city is hard to evaluate. Signal path loss models exist but they are complex eg. Okumura-Hata, empirical COST-Walfisch-Ikegami. A heuristic approach based on buildings is proposed, for deriving a simple index. Terrain due to hills is ignored as they are often gainfully used as transmitting sites. T is assumed to be a function of building density and building heights. Hence, T (city) = function (D, H) = function (√(D*H)), using their geometric mean. D is building density (buildings/A) where A = available area (sq. km) for construction, and H = non-linear grading points for buildings/A, (Skyline ranking, www.emporis.com/en/bu/sk/st/sr). The nth root of [√(D.H)] is taken, to reflect the weighting of T in the generic equation. Sample results are shown in Table 1 where n = 10. Changing n does not alter the ranking. Hong Kong ranks highest (T = 0.53) and Beijing (T = 1) is the reference; T is a relative index. For comparison, the same band eg UHF applies.

Mobile Reception Tests (Hong Kong)

Hong Kong is a densely built-up city, with a population density ranking third in the world, at 6,350/ sq. km (average) and > 50,000/ sq. km in some areas. Its building density (D), based on available construction area, is one of the highest in the world.

Mobile reception tests were conducted (www.ofta.gov.hk/en/report-paper-guide/report/technical.html), by parties including RTHK. The following outlines 3 sets of results: (1) Satisfactory outdoors (VHF 11B, SFN, DAB video); (2) Satisfactory outdoors (UHF Ch. 47, DVB-H, QPSK, code rate 1/2), for 90% locations. Indoor reception: extra 16 dB mean loss at 14 locations; reception failed at about 50% locations, at distances > 5 m from the first wall of building, near ground levels; (3) Satisfactory outdoors (using similar parameters), but indoor reception needing extra 16 dB signal was not assured in vicinity of the test routes. Hence reception in open areas seems satisfactory but indoor reception is a major issue to be resolved.

Indoor Reception

For a heavily built-up city, the law of diminishing returns applies to capex in improving indoor coverage. The skyline is changing as high buildings continue to emerge. Viewer habits should be studied to assess the business case. Poor indoor Mobile TV broadcast mode reception may fallback to the cellular mode eg. 3G/ 3.5G/ WiFi video-streaming. Stop-gap measures include indoor repeaters based on WiFi. In future, emerging WiMax, LTE and UMB, using OFDM and MIMO on wireless, could enhance indoor TV viewing using femtocells on 3G or Mobile WiMax.

Mainland China and Hong Kong

Mainland China has over 520M mobile subscribers and 80M high-end mobile phones, hence a huge potential for Mobile TV. Standardization is still evolving as systems are being assessed. In Hong Kong, DTT with HDTV was rolled out from end 2007, using the Chinese National Standard GB 20600-2006, hence realizing the synergy described (J.Yip, Media Digest, 3/2006). An extension of the synergy to Mobile TV helps improve the economies of scale in implementation and also roaming.

Summary

The generic growth equation is elaborated, focussing on Mobile TV. Assessing soft factors by means of metrics, sustainable growth, the tri-partie relationship among government/ broadcaster/ telecom operator and the Terrain factor (T) are explained. Mobile reception test results in Hong Kong are discussed, addressing indoor reception. Additionally, the synergy between mainland China and Hong Kong is highlighted.

1. Mobile TV Development: How to drive it?

(Acknowledgement: adapted from ABU Digital Broadcast Symposium, March 2008)

Powerpoint

Article

2. Digital TV Development:

http://www.rthk.org.hk/mediadigest/20070614_76_121465.html

3. IPTV Development:

http://www.rthk.org.hk/mediadigest/20061214_76_121247.html

4. HDTV Development:

http://www.rthk.org.hk/mediadigest/20060316_76_120867.html