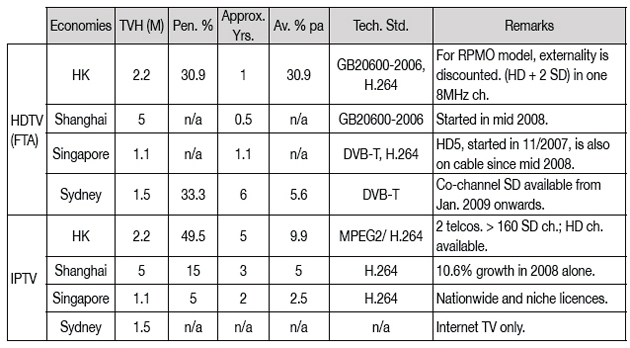

Table 1: HDTV and IPTV in HK, Shanghai, Singapore and Sydney (estimated data, over the growth years)

Table 1: HDTV and IPTV in HK, Shanghai, Singapore and Sydney (estimated data, over the growth years)HDTV and IPTV in HK

DTT/ HDTV was introduced end 2007 using GB20600-2006 (ie DTMB, C=3780). HDTV and its co-channel SDTV channels on SFN use MPEG4 (H.264). MHEG5 (middleware) and Dolby 5.1 audio are also deployed. TVB and ATV provide the transmissions. Population coverage has reached 75 % since August 2008 and DTT penetration 32 % of TVH by end Jan. 2009. Almost all set-top boxes (STB) sold are HDTV-capable. Technical details are described on OFTA’s website (www.ofta.gov.hk).

IPTV services are provided by two telcos (PCCW, CTI). Household broadband penetration was 78% at end 2008. Technologies used include ADSL, ADSL2+ and FTTH, offering 6 - 100 Mbps. Penetration has reached about 50% after about 5 years ie averaging a healthy 10% pa.

Analytical Model (RPMO)

A generic growth equation was previously introduced. The soft factors ie R (Regulatory), P (Pricing), M (Marketing), O (Others, covering Content, Consumer Habits, Device Attributes, Quality), unlike the hard factors, are more controllable. The hard factors are critical for start-up as they are the inherent obstacles for which large start-up capital funds may be incurred. Please refer to Media Digest (3/06, 12/06, 6/07, 3/08). An Excel-based RPMO calculator has been developed to assist broadcasters and operators in digital TV planning and development.

The RPMO calculator (downloadable from RTHK’s web version of this paper) has data-entry boxes for R, P, M and O. For each box the user enters the major issues; one could block copy and paste using the Word file. For each issue, a weight (0/1/2/3) and a mark (0.0 – 5.0, ie ranging from No-go, Bad, Poor, Fair, Good, to Excellent) are assigned by the user. Under each factor, the major issues are inter-related hence an arithmetic average is used. For the relatively independent R,P,M,O factors, a geometric mean is derived. Some objectivity must be exercised in the subjective assessments eg a consultant/ academic may be helpful.

Major Issues

For HDTV, examples of major issues are:

Regulatory, R :

- High spectrum availability

- Liberal spectrum licensing

- Liberal cross-platform content policy

- Firm timeframe for analog off

- High HD quota

Pricing, P :

- Pricing of HDTV receiver

Marketing, M :

- Strong viewer education

- Strong promotion by the industry

Others, O :

Content:

- Abundent programming

- Compelling HD content

Consumer Habits:

- Strong TV viewing habit (based on h/wk)

- Identifiable, dominant viewing preferences

Device Attributes:

- High availability of STB and LCD/ PDP

- EPG and subtitling

- Easy of use of equipment

- Interactivity and recording

Quality:

- Comprehensive signal coverage

- Quality (Mbps, MPEG2 or H.264)

Examples of “good” conditions ie for a mark of “4” are: mostly free cross-platform content flow, a well-defined analog-off timetable devoid of if’s and but’s, an HD quota of 21 h/wk or more, initial HDTV outlay (set + installation + subscription) at 2% or less of GDP/capita, average viewing of 21 h/wk or more, strong signal coverage of 75% or more, HD at 15 Mbps or more, preferably on H.264.

Similarly, for IPTV, examples of major issues are:

Regulatory, R :

- Liberal IPTV licensing policy

- Free-market triple-play

- Liberal cross-platform content policy

Pricing, P :

- Pricing of STB and installation

- Pricing of annual subscriptions

- Competitive package-bundling

- Strong anti-priracy protection

Marketing, M :

- Strong advertizing efforts

- Attractive promotional packages

- Free channels offered

- Strong front-line promoting efforts

Others, O :

Content:

- Large number of channels

- Wide range of content

- Exclusive, compelling, premiere content

Consumer Habits:

- Strong TV viewing habit (based on h/wk)

- Identifiable, dominant viewing preferences

Device Attributes:

- Set-top box features

- EPG and subtitling

- Interactivity and recording

- Easy of use of STB

Quality:

- Reliability of network service, STB, etc.

- Picture Quality (Mbps, MPEG2 or 4)

- Broadband speed (Mbps) for triple-play

Similarly, “good” conditions for a mark of “4” are: mostly free cross-platform content flow, IPTV pricing pa at less than 1% of GDP/capita, 100 or more channels available, average viewing of 21 h/wk or more, triple-play broadband speed at 10Mbps or higher.

Externalities are issues external to the RPMO model. The hard factors may also need to be considered. The impact of the Olympics 2008 is included as it has been watched worldwide. For HDTV in HK, a significant externality was the pre-existence of an estimated 0.4 M large-screen displays. Due to their high costs, it could be assumed that these consumers would have also purchased a STB had it been available before launch; this externality is discounted in the analytical model.

RPMO Analyses for HK and 3 selected economies

With the help of some M.Sc. students, the model has been applied. For HDTV, only HK and Sydney are described, as FTA HDTV is picking up in Shanghai and also Singapore. IPTV in Sydney is excluded as the current broadband TV service is only Internet/ web TV. Table 1 refers.

Based on the penetration figures (averaged over the years and estimated from readily available data) and on the evaluation results, benchmarking curves and an aggregate curve are derived. These could depend on the evaluation panel. (For IPTV in Shanghai, a separate evaluation has been made for 2008, RPMO value = 4.5 whilst the actual growth = 10.6%.)

Major issues for which further efforts could accelerate growth are as follows.

HDTV :

Affordable HDTV set prices (and prices are falling), compelling HD content, eg major events, liberal cross-platform content-flow policies, strong promotion and marketing.

IPTV :

Liberal cross-platform content-flow policies, exclusive, compelling, premiere content, large number and range of channels, high broadband speeds and reliability.

(IPTV experiences stiff competition from cable television, particularly on content.)

Summary

This paper introduces a computer-assisted assessment method. The application is exemplified by analysing HDTV and IPTV in HK, Shanghai, Singapore and Sydney. Benchmarking curves are presented.

1. RPMO Calculator

2. ABU Digital Broadcast Symposium

Paper

Powerpoint